The Canadian Vanguard Stock Market Report At Market Close – Tuesday, April 23, 2024 .

.

Data Driven Stock Market Analysis And Report

The Toronto Market

The TSX advanced 139.76 points or 0.64% to close today’s market session at 22,011.72. The TSX has gained now for four consecutive sessions.

Ooo La La! We had an all-stars sectors performance on Tuesday. All the major sectors of the TSX were up – all in green, broad-based performance. Technology led the sectors with 2.49% gain. Healthcare gained 01.35% while Telecommunications Services gained 0.82%; Durable Consumer Goods & Services gained 0.66%; Industrials sector followed with 0.64% gain and Basic Materials was next with 0.46% gain. Financials probably could have done better but settled for a 0.43% gain; Energy gained 0.40% and Utilities gained 0.20% to round the session up for the sectors.

Auto & Truck Manufacturers industry within the TSX was up 6.03%; Industrial Machinery & Equipment gained 3.85%; Air Freight & Courier Services gained 3.48%; Textile & Leather Goods industry was up 3.45% and IT Services & Consulting was up 3.36%.

Today’s Statistics: Today, the gaining issues (Advancers) totally outnumbered the declined issues (Decliners). The ratio of Advancers to Decliners was 3.38-to-1.0 or in practical terms, for every sixteen Advancers there were five Decliners . In real numbers, 1,110 Advancers to 328 Decliners with 104 Unchanged. The total volume of shares traded for gaining stocks was 235,800,039 or 75.8%, the total volume for declined stocks was 67,594,109 or 21.7% and 7,822,009 or 2.5% for “Unchanged”.

Today, there were 19 new 52-Week Highs and 11 new 52-Week Lows. Monday, there were 18 new 52-Week Highs and 26 new 52-Week Lows.

The total volume of stocks traded at the TSX today was 311,216,157 compared to 308,441,962 yesterday, roughly 1% percent increase. Today’s volume of 311,216,157 was ten percent (10%) lower than the average of the ten most recent market sessions.

.

The US Markets

The Dow Jones Industrial Average repeated yesterday’s triple digit gain performance today. All the indexes were star performers today. The Dow index gained 263 points, or 0.69% to close the market session at 38,503.69. The S&P 500 was up 59.95 points, or 1.20%, to close at 5,070.55. The Nasdaq Composite gained 245 points or 1.59%, to close at 15,696.64.

![]()

On the US side, nine of the major sectors ended the market session in green with Technology sector leading the charge with 1.93% gain. Healthcare was up 1.46%; Durable Consumer Goods & Services was up 1.18%; Telecommunication Services gained 1.14%; Industrials sector gained 1.09% while Financials gained 1.08%; Utilities sector gained 0.81% and Energy sector was up 0.52%. Basic Materials declined -0.32% to be the only sector to end the session in the red.

Airport Services continues to outperform, leading the industry groups with 7.61% gain and Advanced Medical Equipment gained 3.68%. The Homebuilding industry gained 3.33% while Computer Hardware gained 3.03% and Retail – Department Stores was up 2.93%.

Today’s Market Statistics: Today, the gaining issues (Advancers) outnumbered the declined issues (Decliners) on the NYSE. The ratio of Advancers to Decliners was 4.89-to-1.0 or in practical terms, approximately for every five Advancers there was one Decliner. In real numbers, 3,342 Advancers to 683 Decliners with 235 Unchanged. The total volume of shares traded for gaining stocks was 751,995,762 or 78.1%; the total volume for declined stocks was 200,281,894 or 20.8% and 11,195,149 or 1.2% for “Unchanged”.

There were 86 new 52-Week Highs and 30 new 52-Week Lows. Yesterday, there were 34 new 52-Week Highs and 95 new 52-Week Lows.

The total volume of stocks traded at the NYSE today was 963,472,805 compared with 950,041,971 yesterday, a 1.4% increase. Today’s volume of 963,472,805 is about three per cent lower than the average of the ten most recent market sessions.

On the NASDAQ, the Advancers prevailed over the Decliners today by a ratio of 2.74-to-1 or roughly for every seven Advancers there were five Decliners. In real numbers, there were 3,113 Advancers to 1,133 Decliners with 288 Unchanged. The total volume of volume-gaining stocks was 3,608,032,593 or 70.6%; the total volume of declined-volume stocks was 1,468,651,391 or 28.8% and 30,270,567 or 0.6% for “Unchanged”.

There were 57 new 52-Week Highs and 85 new 52-Week Lows. Yesterday, there were 25 new 52-Week Highs and 241 new 52-Week Lows. Yesterday was quite bearish in spite of market performance otherwise. Today, the situation remains not bullish but much less bearish.

The total volume of stocks traded at the NASDAQ today was 5,106,954,551 compared to 5,083,746,770 yesterday, a practically negligible increase. Today’s volume of 5,106,954,551 is about 1% percent higher than the average of the last ten market sessions.

10 –year Treasury Yield: The yield on the benchmark 10-year Treasury note fell 3 basis points to 4.59%.

The market outlook remains Market In Early Rally Mode. We strongly recommend that you wait for the rally to gain traction before jumping in. We need to wait a couple of market sessions for the rally to either confirm or fail. Today’s market session was a good step but we need to wait for the market to confirm in order to avoid surprises from the market.

.

Regular Market Day Features

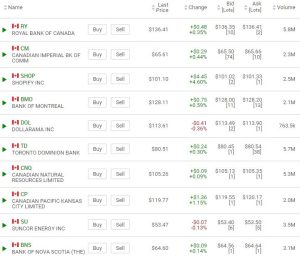

Beginner Investor’s (Canadian stocks) Watchlist

The Canadian Vanguard Chinese Stocks Watchlist

EV, Energy and Resource Stocks Watchlist

Tesla was up more than 10% at the overnight market even after reporting relatively weak results but promising cheaper EVs in future.

IMPORTANT NOTICE

Readers are reminded that the market’s performance at the following day’s market session may completely differ from the market performance at the overnight markets.

SUBSCRIPTION Offer: We thank you for following our Stock Market posts but please be aware that we shall soon be restricting these articles to subscribers only.

We do not send this publication by email to readers. If you receive a copy by email please simply forward the email to us.

Our reports are composed by humans after proper analysis and detailed research. It is neither AI nor machine generated. We do not, like AI, make things up.