Condos are expected to be cheaper compared to houses, but the soaring fees are closing the gap

Aniket Jadhav and Anjali Jachak are realistic about what kind of home they can afford.

The young couple knew there was no chance they could buy a house given the million-dollar prices in Toronto and surrounding cities, despite having two comfortable salaried incomes. So, they turned their eye to condos.

Having saved a decent down payment, the pair were confident they could search for a two-bedroom, two-bathroom home costing up to $800,000. But after meeting with a mortgage broker and a realtor, they quickly found themselves paring back that budget — they simply hadn’t realized condo fees would be so high.

“Initially … we only accounted for our mortgage,” Jachak said, as the pair recounted units where the fees added $1,000-plus per month. It’s been a hard pill to swallow as the number of homes in their budget has thinned. “If we’re finding it difficult, we can’t imagine others — with a single-income family, or a low-income family — how they would even survive in the city,” Jadhav said.

Across Toronto, as home ownership has been an increasingly fading prospect for young residents, condos are often the most attainable option. But costs are still steep, with the average GTA condo costing about $700,000 last month, according to the Toronto Regional Real Estate Board. Even if a household could save enough to put 20 per cent down, requiring more than $140,000, a 5.6 per cent fixed-rate mortgage would still cost them more than $3,400 per month.

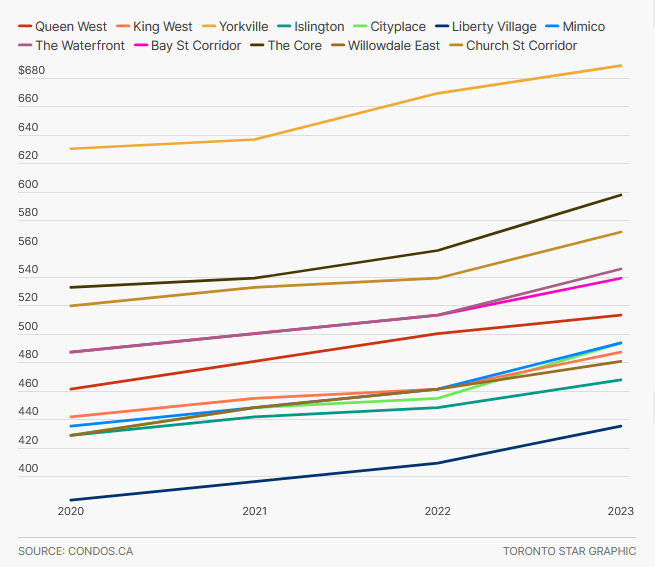

And that’s before you consider the condo fees: the baked-in costs of ownership that can include anything from all utility bills to simply maintenance of common areas. Data from across a dozen Toronto neighbourhoods from the listing site condos.ca shows those fees are rising faster, with the cost per square foot increasing at twice the rate in 2023 as it has in previous years.

In 2020, the average fee was 73 cents per square foot, or roughly $475 per month for a 650-square-foot home. That number varied by neighbourhood — from pricier Yorkville to the lower fees charged in Liberty Village. In the ensuing year, the average fees rose by 2.98 per cent; then 2.72 per cent from 2021 to 2022. Those changes are in line with “historical norms,” said condos.ca co-founder Andrew Harrild. But from 2022 to 2023, the average fees rose by 5.51 per cent.

At an average of 81 cents per square foot, the owner of a 650-square-foot unit would pay $620 more per year compared to 2020.

How much have maintenance fees increased for a 650-square-foot condo across Toronto?

The average monthly maintenance fee across 12 Toronto neighbourhoods rose by 5.51 per cent in 2023, versus 2.72 per cent and 2.98 in the preceding years, condos.ca data shows. Here’s what that means for a 650-square-foot unit.

“This isn’t a surprise given what we’ve seen with inflation recently,” Harrild said, noting it was “reasonable” to assume the same kind of rise into 2024. That change has real consequences for those hoping to buy a home, he added. “After mortgage payments, maintenance fees are the next biggest expense.”

In some buildings, Jadhav and Jachak noticed condo fees stretched further; largely in older buildings, the couple noted the fees covered a wider slate of utilities such as heat and hydro than in newer towers.

But as buyers try to find buildings with fees that don’t overstretch their budgets, industry players stress a parallel caution — making sure the fees aren’t too low to adequately cover the building’s future repairs.

Realtor Desmond Brown, along with Harrild, says buyers should consider a building’s financial health by reviewing its status certificate during the sale process — which can reveal risks from special assessments to lawsuits.

A special assessment is a process by which a condo corporation turns to owners to cover an extraordinary one-time cost or budget shortfall. The cost is layered on top of the fees condo owners pay monthly.

“Buyers should not be sucked in by low maintenance fees,” Brown said, urging extra caution if a new condo is charging especially low fees.

“Take a close look at the budget and look at what is going to be spent this year, and what it’s going to be spent on. Are there any major repairs needed in the building, and can the reserve fund cover those repairs?” Brown asked. “If not, each condo owner is going to have to dip into their pockets.”

Still, Brown knows that for many new buyers, higher borrowing costs and still-sky-high prices mean less financial wiggle room around maintenance fees. “You take a look at what it costs already to carry a mortgage — to add on an unexpected $300 on a maintenance fee (compared to) what you thought you were going to pay? Then, in most cases, it’s a deal breaker,” he said.

Jadhav and Jachak feel fortunate they can even consider home ownership, seeing friends and family members alike struggle to afford the same option. For them, the decision to buy was spurred by Toronto’s rising rental prices.

“With rents being the way they are right now, we might as well pay a couple thousand more per month and try to own a property, and see the value of the property appreciate over time,” Jadhav said. But while the purchase price might be up for debate, he noted condo fees were an immovable cost as they continue their home hunt.

“Condo fees are not something we can go and negotiate around.”

This article was first reported by The Star